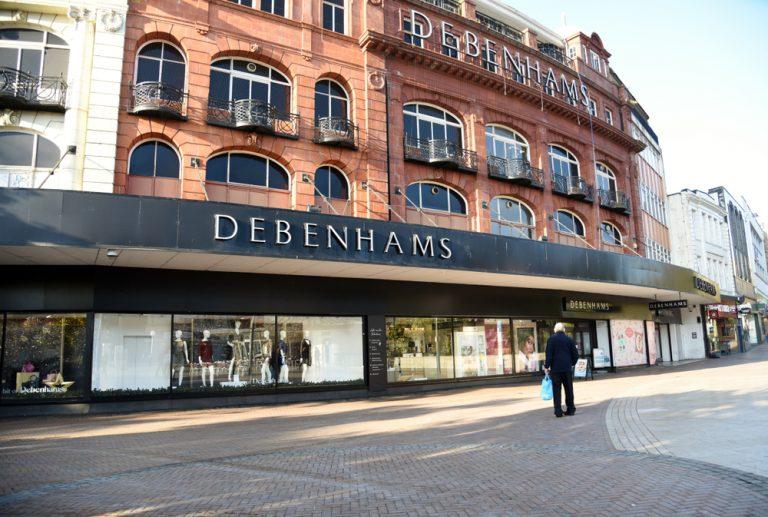

Debenhams shares soar amid credit facilities extension and sourcing partnership

Department store chain Debenhams announced on Tuesday that it has agreed to extend its credit facilities and a sourcing partnership with Li & Fung. Shares in the company soared 39% during trading on Tuesday morning.

It has agreed to an additional 12-month senior secured credit facility. The additional facility provides £40 million on increased liquidity headroom, which will be available to draw as required.

Additionally, the new facility agreement will be a bridge to facilitate a broader refinancing and recapitalisation. Against this backdrop, the company has said it will continue to engage constructively with with its stakeholders. It intends to conclude a “comprehensive refinancing” by the end of the period.

Stagecoach announces short-term rail franchise with Department for Transport

Stagecoach Group plc (LON:SGC) announced on Tuesday that its subsidiary, East Midlands Trains Limited, has agreed a new short-term rail franchise with the Department for Transport. Shares in the company were trading slightly higher during early trading on Tuesday.

The new franchise will begin on 3 March 2019 and is expected to run until at least 18 August of the same year. The Department for Transport has the discretion to extend the franchise by up to 24 weeks on terms that have been agreed, Stagecoach said.

Stagecoach has outlined the benefits and improvements that customers and communities will experience as a result of the franchise. Under the agreement, the £1.5 billion Midland Main Link upgrade is set to improve capacity and reduce journey times. Additionally, the continuation of the investment programme will improve stations and trains, including accessibility improvements. Moreover, it will see the roll out of smart ticketing in March, as part of a wider National Rail scheme.

East Midlands trains will focus on ensuring readiness for the new franchise. This includes plans to add extra seats from 2020.

Under the agreement, revenue risk will sit primarily with the Department for Transport.

East Midlands Trains is set to earn a modest sum under the contract. A profit sharing arrangement with the Department for Transport will be applicable. In December, Stagecoach reported its results for the first-half of the financial year. The bus and rail operator revealed a pre-tax loss of £23 million for the first six months of the year, comparing to the £97 million profit earned the year prior. It slashed its dividend for the full year to April 2018, causing shared to drop over 7% in June. After severe weather across the country during early 2018, UK bus regional revenue dropped by 0.1% on a like-for-like basis. In London, revenue drop was significantly larger at 4.3%. At 09:36 GMT Tuesday, shares in Stagecoach Group plc (LON:SGC) were trading at +1.63%.AA’s motor insurance division sees strong growth, roadside breakdown stumbles

AA’s (LON:AA) motor insurance division has experienced a “solid” operational performance throughout the financial year ending 31 January 2019. However, its roadside breakdown business continues to stumble. This was announced in a pre-closing trading update on Tuesday ahead of its full financial year results announcement on 3 April.

Trading EBITDA is expected to not be below then £340 million mark, which remains within the company’s guided range of £335 million – £345 million.

In September, AA announced that its profits had dropped by 65% for the first six months of 2018.

In February, it warned that its full-profit would fall short of expectations. The AA’s insurance division continues to perform in line with the company’s expectations. Over the year, motor policy grew 16% to 731,000 which is ahead of expectations. Additionally, its house insurance policy book rose by 1.5% to roughly 830,000. As for roadside, the AA retained for extended all of its primary contracts. These include contracts with Lloyds Banking Group, Volkswagen Group, Suzuki, and Jaguar Land Rover. Average income per business customer increased by 5% to £21, according to the AA this reflects the new contract wins and additional revenue recognised under its pay-for-use contracts. Average income per paid member increased to £162, growing 3% from last year. This increase remains broadly in line with inflation. Paid personal memberships dropped by 2% to 3.21 million during the year. Retention was just over 80%. The company said it had anticipated the decline in paid personal memberships, primarily due to its previously announced decision to re-phase its summer marketing campaign. This is in addition to the impact of regulatory pressures and continued competitor activity. AA has said that it continued to experience “strong and predictable” levels of cash conversion. It expected total capex spend for the 2019 financial year to remain broadly in line with its guidance of £105 million. At 09:13 GMT on Tuesday, shares in AA plc (LON:AA) were trading at +0.37%.TUI losses widen following hot British summer and weaker pound

Travel company TUI (ETR:TUI1) revealed its first-quarter results of the financial year on Tuesday through a stock market announcement. The results show a deeper earnings as a result of weather conditions, a change in consumer demand from the western to the eastern Mediterranean and a weaker pound. Shares in the company dropped over 4% during early trading on Tuesday.

Underlying EBITA loss deepened to -€83.6 million for the three months through December. This compares to a -€36.7 million on-year.

Group turnover grew 4.4% to €3.7 billion. Additionally, customer volumes across all markets jumped by 1.2% to 3.7 million.

TUI has said that its current trading for summer 2019 remains broadly in line with prior year and average selling price is flat year-on-year.

It has stressed that the market environment, for all travel companies, remains very challenging and impacted by a variety of factors. These factors include the impact of the unusually hot and extended summer in 2018, which has caused an increase in the amount of late bookings. Next, there has been a shift in demand from the western to the eastern Mediterranean, which has created an overcapacity in other destinations such as the Canary Islands. Finally, sales of higher-margin products to British customers have been affected by the weakness of the British pound. TUI said that it had initially expected these challenges to primarily impact the first half of the financial year. However, it is now predicting that it will extend into the second half. As a result, full-year earnings are expected to be broadly stable with the 2018 financial year’s €1.18 billion figure. Last week, TUI downgraded its earnings guidance, re-emphasizing it in today’s results. Thomas Cook then followed by announcing that it had been hit by a reduced demand for winter sun and British consumer uncertainty. CEO Fritz Joussen commented on the announcement: “Global trends for tourism remain intact. TUI is financially strong with a second strategic and operational positioning. We are continuing to deliver our transformation as a digital platform company.” At 09:29 GMT Tuesday, shares in TUI AG (ETR:TUI1) were trading at -4.30%.Sterling drops after lowest UK GDP growth reading since 2012

Sterling weakened on Monday after the release of UK growth figures that showed the pace of growth had declined to the lowest levels since 2012.

Growth in Q4 2018 stumbled to 0.2% as the service sector was only are to post growth and Business Investment declined.

Growth for 2018 fell to 1.4% down from 1.8% on 2017 sending GBP lower against most major currencies.

GBP/USD was trading at 1.2902 at lunchtime in London.

The fall in GBP/USD compounds a poor February for sterling thats seen the currency pair drop over 200 points.

1.4% fall in Business investment in Q4, the 4th consecutive quarterly fall in a row https://t.co/HjIDTfZktM pic.twitter.com/kNjKFmpYRB

— ONS (@ONS) 11 February 2019

Europe wide weakness

The decline in the UK’s growth rate was attributed to lower factory orders and activity in the automotive sectors. Fear over Brexit were blamed for the poor figures as businesses held back on making decisions until the UK government gave more certainty on the withdrawal process. Despite Brexit being blamed for the weakness, the UK’s disappointing GDP’s figures comes hot on the heels of a raft of data from mainland Europe suggesting the economic picture is weak throughout the continent. Italy have recently confirmed they are in a technical recession and Germany could well do the same following a 1.6% decline in factory orders suggesting Europe’s biggest economy is taking a turn for the worse. While Italy’s politicians blamed their recession on ongoing Eurozone austerity, Germany’s woes are firmly driven by a declining demand for goods, especially automotives – something that was also evident in the UK economy.UK services strength

The UK’s service sector was the only area of the economy that grew with strong growth in IT. Business investment was weak, posting the fourth quarter of decline. Head of GDP Rob Kent-Smith commented on the data: “GDP slowed in the last three months of the year with the manufacturing of cars and steel products seeing steep falls and construction also declining. However, services continued to grow with the health sector, management consultants and IT all doing well. “Declines were seen across the economy in December, but single month data can be volatile meaning quarterly figures often give a better indication of the health of the economy. “The UK’s trade deficit widened slightly in the last three months of the year, while business investment again declined, now for the fourth quarter in a row.”Lonmin production hit after miner fatalities

Lonmin (LON:LMI) updated the market on its production numbers for the first quarter of 2019.

The platinum miner said production was down 166,000 tonnes to 2.2 million tonnes, down 7.0% on the same period last year.

This was as a result of two fatalities, which led to stoppages as the company worked towards reviewing safety conditions.

The statement added that the incidents had occurred after a 15-month fatality free period.

Ben Magara, Chief Executive Officer, said: “The loss of our colleague is deeply regretted and we extend our deepest condolences to his family and friends. Our first quarter’s production is always our most disturbed and challenging period.

Looking ahead to the next quarter, Magara said:

“I am encouraged by the increase in the PGM basket price driven by Palladium and Rhodium. Going forward into the second quarter, the Lonmin team continues to focus on safe mining production. We are therefore maintaining our sales, costs and capex guidance for 2019. The challenges of this quarter and the volatility of the exchange rate underscore the vulnerability of our business and the importance of a sustainable solution for the company.”

Lonmin is a platinum mining company that is primarily focused in South Africa.

Shares in Lonmin are currently +8.55% as of 13:53AM (GMT).

Elsewhere in the markets, Tower Resources shares (LON:TWR) rallied after the company announced it had made a gas discovery nearby one of its wells.

Meanwhile, SSE shares (LON:SSE) remained flat after the company updated the market on its performance during the last three months of 2018.

Zinc Media confirms incoming chief executive

Zinc Media (LON:ZIN) confirmed the appointment of Mark Browning as its new incoming chief executive.

The media, communication and production company said Browning is set to join the board and commence is role on the 23rd of April 2019.

Following his departure, previous chief executive David Galan is set to assume a role as a non-executive director of Zinc Media.

Peter Bertram, Chairman, commented on the announcement:

“We look forward to Mark joining the Company and are pleased that his start date is now confirmed. We are excited for him to begin a new strategy to build Zinc Media’s ambitions in the TV and digital markets, using his vast experience in the field.

Furthermore we are delighted that David has agreed to step into a role as a non-executive director of the Company and believe that his knowledge and experience in re-shaping the Group over the last few years will continue to be valuable to the Board and in helping to ensure a smooth transition for Mark.”

Zinc Media operate a range of television production companies. These include Blakeway, Brook Lapping, Films Of Record and Reef Television.

It works with TV broadcasters such as the BBC, Channel 4 and Channel 5.

Shares in the media firm are down marginally as of 13:16PM (GMT). Shares are currently trading down -1.23% as of 13:17AM (GMT).

SSE issues profit warning after losing 160,000 customers

SSE issued a profit warning on Friday after revealing it had lost 160,000 customers in the last three months of 2018.

The energy giant also said that a European Court ruling, which halted state aid for UK energy companies, would also impact earnings.

Accordingly, the company reduced its earnings forecast per share to be between 64p to 69p.

The company said it would be maintaining its full-year dividend of 97.5p per share.

Alistair Phillips-Davies, chief executive of SSE, commented: “We continue to make good progress in our core businesses of regulated energy networks and renewable energy, complemented by flexible thermal generation and business energy sales. We have also demonstrated our ability to create value for shareholders through the recent sales of stakes in our telecoms business and selected onshore wind farms with expected proceeds of over £1bn. We are also making progress in assessing the options for the future of the energy services business.

“SSE has a clear strategy and good long-term prospects for its high-quality core businesses and assets that contribute to the transition to a low carbon economy and will support the creation of value and delivery of our dividend plan in the years to come.”

SSE is considere to be one of the “big six energy providers” in the UK.

Nevertheless, the country’s largest energy firms have been struggling as of late.

Fierce competition and rising energy prices have led many of the top providers to shed a considerable amount of customers.

Rival provider British Gas, which is owned by Centrica (LON:CNA), lost 1.3 million energy accounts in 2017 alone.

SSE shares (LON:SSE) are currently up marginally at +0.47% as of 11:01AM (GMT).

Tower Resources shares rally amid gas discovery

Tower Resources shares (LON:TWR) rallied on Friday after the company updated the market on its Brulpadda well.

The oil and gas exploration company said it “reported a significant gas condensate discovery” located in the Outeniqua basin, offshore South Africa, neighbouring its Brulpadda well.

According to the company statement, the company said that:

‘Total have stated that they believe the new discovery could hold between 500 million to over one billion barrels of oil equivalent and they now intend to drill several further exploration wells on Block 11B/12B to test additional prospects.’

At the start of the year, Tower Resources announced its intention to raise £1.7 million in capital for its Cameroon project.

The company said it would raise the funds through the placing 170 million new ordinary shares at 1p each, with the listing set to take place at the end of January.

Tower resources is an AIM-listed company. It was admitted to the London Stock Exchange in 2005.

The firm has projects in Cameroon, Namibia, South Africa and Western Sahara.

Shares in Tower Resources are currently trading +16.67% as of 10:41AM (GMT).

Shaftesbury: footfall was “robust” over Christmas

Shaftesbury (LON:SHB), the London West End property investor, announced a trading and finance update on Friday for the period 1 October 2018 to 7 February 2019. The company has said that footfall and trading was “robust” over the period.

Shares in the property investor dropped slightly during early trading on Friday.

Shaftesbury is a real estate investment trust with a portfolio that extends across 15 acres in London’s West End. It focuses on retail, restaurants and leisure in the highly popular locations around Carnaby, Seven Dials and Chinatown. Moreover, its portfolio includes substantial ownership in East and West Covent Garden, Soho and Fitzrovia.

Over the Christmas and New Year festivities, footfall in Shaftesbury’s locations was “robust”. Indeed, its occupiers generally reported a turnover growth when compared to the year prior. This seems to differ from the national reports of a tough trading climate as Shaftesbury’s restaurants, cafes, pubs and bars were all particularly busy over the holidays.

Tough trading conditions have been well publicised throughout 2018, perhaps contributing to a growing consumer anxiety in spending. Shaftesbury’s properties, however, seem to have not suffered as profoundly as other retailers.

On Boxing Day, average footfall across the UK dropped by 3.1%, and reports of decreasing footfall were also evident earlier on in 2018.

Chief Executive Brian Bickell commented on the announcement:

“During the important trading season leading up to and including the Christmas and the New Year holidays, footfall in our locations has been robust and our occupiers generally reported growth in turnover compared with the same period in 2017. In contrast to reports of subdued leisure spending nationally, our restaurants, cafes, pubs and bars were particularly busy throughout the festive period.”

Additionally, the company reported a resilient demand for its regular space as occupancy remains high. Equally, it has made progress on larger schemes such as the let of Thomas Neal’s Warehouse and the submission of a planning application for 72 Broadwick Street.

At 09:47 GMT Friday, shares in Shaftesbury plc (LON:SHB) were trading at -0.34%.