Just Eat shares dip on CEO resignation

The chief executive of Just Eat has unexpectedly resigned.

The takeaway ordering website revealed the news on Monday morning that Peter Plumb will be leaving the group with immediate effect.

Plumb is leaving the group just 16 months after joining from MoneySavingExpert.com.

Shares fell 2.3% on the back of the news and have fallen 18% over the past 12 months.

Peter Duffy, Just Eat’s chief customer officer, will replace Plumb whilst the group searches for a replacement.

In the trading update released on Monday, Just Eat said that it expects a 2018 revenue of £780 million and underlying core earnings between £172 million and £174 million, ahead of analysts’ consensus forecast.

In a statement, Plumb said: “2018 was another year of strong growth for the group. The business is in good health, and now is the right time for me to step aside and make way for a new leader for the next exciting wave of growth.”

Chairman Mike Evans said: “The board would like to thank Peter Plumb for setting Just Eat on a new course which better places it to address a much larger and rapidly expanding market. We wish him well for the future.”

“Peter Duffy and the senior leadership team will continue to drive the execution of our strategy, which has the full backing of the board. Peter Duffy and Paul Harrison, chief financial officer, will provide a full update to the market at our full year results.”

Russ Mould, who is an investment director at AJ Bell, said on the news: “The departure of Peter Plumb as chief executive of Just Eat after less than a year and a half in the job is the latest hiccup for the previous stock market darling. At first glance, remarks from Plumb that now is the right time for him to step aside seem a bit odd given the short amount of time he’s been in the role. However, his departure isn’t a surprise given how the company’s share price had lost upward momentum under his tenure, plus the business had come under attack from activist investor Cat Rock.”

“Cat Rock had complained that Plumb had been in the job for more than a year and that shareholders were still waiting for Just Eat to announce appropriate financial goals and for the board to hold management accountable with a properly aligned remuneration package. Although there is no reference to the activist investor in Plumb’s departure announcement, one can certainly speculate the events are linked,” he added.

Shares in the group (LON: JE) are currently trading down 0.73% at 653,60 (1256GMT).

How the internet has opened up investment

The past two decades have seen the number of active traders grow from a few thousand to an astonishing 9.6 million. What has made this possible? Academics can give you lots of different reasons but most of them boil down to one thing: the internet. By making trading more accessible, improving traders’ skills and supplying the information they need for success, it has enabled many more to get involved and stay involved, radically changing the financial markets. How did it happen and what does it mean for traders operating today?

Access to trading

There used to be a lot of barriers making it difficult for the average person to be involved in investing, but a combination of technology and consumer pressure has begun the process of breaking them down.

- Affordability – investors used to need around $150,000 just to get started. Now you can start with just $150, including the cost of paying broker fees, though it’s wise to spend more if only to ensure that you have good equipment.

- Location – it’s no longer necessary to be in a city with a stock exchange – the internet lets you trade from anywhere you can get a connection. This also cuts down costs because you don’t need to be able to afford big city accommodation.

- Time – Traders used to be restricted to trading nine to five – or fewer hours – in their own countries. Now you can trade through exchanges all around the world and there’s almost always somewhere open for business, so it’s easier to do it alongside a day job.

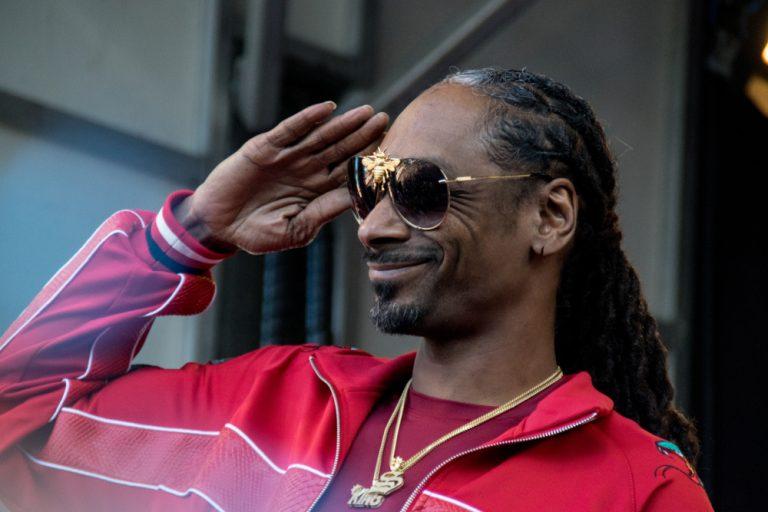

Snoop Dogg invests in Swedish fintech start-up Klarna Bank

The American singer, rapper, record producer, television personality, entrepreneur and actor, Snoop Dogg, has invested in a Swedish fintech company valued at $2.5 billion (£2 billion).

Snoop Dogg’s investment firm, Casa Verde, has previously added cannabis companies to its portfolio. He is now set to purchase a stake in the Swedish fintech start-up Klarna Bank.

Klarna Bank was founded in Sweden in 2015. It has now expanded to 14 countries. The bank allows customers to purchase products and services through a variety of different finance options. The platform is currently used by 100,000 merchants and 60 million shoppers. It’s shareholders also include H&M and Visa.

Snoop Dogg, whose real name is Calvin Cordozar Broadus Jr., commented on the announcement:

“I’ve been looking for an opportunity to expand my tech investment portfolio to Europe and seeing the way Klarna operates and how they challenge the status quo, I think it’s a match made in heaven. I’m very excited about this partnership.”

In 2015, the company was valued at $2.25 billion. This makes the Bank one of Europe’s biggest fintech unicorns.

The Chief Executive of Klarna Bank, Sebastian Siemiatkowski, noted that “Snoop is not only a rap legend, but also a successful businessman, with a genuine interest in tech, retail and e-commerce.”

“He has a great understanding of consumer behaviour and is exceptional when it comes to branding and marketing,” Klarna Bank’s chief executive told CNBC.

Snoop Dogg will promote the business as part of a new marketing campaign where he is renamed as “Smooth Dogg”.

This aims to play on the bank’s well known slogan “Smooth Payments”. Over in the UK, the fintech sector remains strong with companies such as CrowdCube and Monzo leading the way. “Fintech”, which is short for financial technology, is flourishing in the UK. Services include payments, equity crowdfunding, peer to peer lending, challenger banks, P2P currency transfer and insurtech. UK fintech is now estimated to be generating £20 billion in annual revenue, and additionally boasts over 60,000 employees.Shares in Debenhams tumble as outlook downgraded

Shares in Debenhams slid 7% on Thursday morning after Moody’s Investors Service changed the department store’s outlook from stable to negative.

“Today’s change in outlook reflects our view that there is a risk that refinancing negotiations may not result in a timely and cost-effective solution and thus the process could ultimately culminate in losses for financial creditors,” said the lead analyst for Debenhams and Moody’s vice president.

“However, notwithstanding this and the company’s elevated leverage we continue to view Debenhams liquidity profile as adequate for the time being,” he added.

The struggling department store has had a torrid year, where share price in the group has tumbled almost 90% over the last 12 months. Last week, the Debenhams chairman Ian Chesire and chief executive Sergio Bucher were both ousted from the board.

Mike Ashley, the owner of Sports Direct and owner of 30% of shares in Debenhams, voted against Chesire and Bucher.

“The board believes that it is in the best interests of Debenhams plc that the executive team remains fully focused on delivery of the plan. In the meantime, the board remains open to constructive suggestions from shareholders that are in the interests of the business as a whole,” said Debenhams in a statement at the time.

This week, the group also said it may close a further 40 stores, which should “address the structural challenge and drive profitable growth”.

The group has already planned to close 50 stores over a five-year period.

Shares in the group (LON: DEB) are currently trading down 5.51% at 2,92 (1407GMT).

Premier Foods reports fall in Q3 sales

Premier Foods saw sales fall over the third quarter, as the group blames logistical issues.

In the 13 weeks to 29 December, the Mr Kipling owner reported a 2.2% fall in sales to £256 million.

“We faced into two sets of challenges in the quarter – lower international sales and our logistics programme, which as expected, affected cake sales volumes early in the quarter,” said Gavin Darby, the group’s chief executive.

“As we look to the fourth quarter, we expect to see a good performance from branded Sweet Treats and we have a good innovation plan lined up,” he added.

Darby will be stepping down in February, where he will be replaced by chief financial officer Alastair Murray on an interim basis.

Whilst sales in sweets declined by 20.7% due to issues surrounding logistics, Premier Foods reported strong sales in Mr Kipling, Bisto and Batchelors.

“As previously announced, we expected Sweet Treats sales to be lower in the third quarter and accordingly, Nonbranded Sweet Treats sales were (20.7%) lower compared to the same period last year,” said the group in a statement.

“This was due to the business experiencing lower sales volumes as a result of implementation challenges associated with its logistics programme, however, customer service levels improved steadily during the quarter. Additionally, the Sweet Treats business exited a number of lower margin seasonal and non-seasonal cake contracts. In the Grocery business, Non-branded sales increased +2.5% as contract wins in Stuffing and Cooking sauces were partly offset by lower sales at Knighton Foods.”

The group have said that full-year profit expectations remain the same.

Shares (LON: PFD) in the group fell on the back of the news but have since recovered and are trading +1.47% (1333GMT).

Primark exceeds expectations and plans new mega store

Much to the delight of its owners Associated British Foods Plc (LON:ABF), Primark exceeded expectations for Christmas trading, despite what they described as a ‘challenging‘ run-up to the festive period.

“The UK performed well and our share of the total clothing market increased significantly,” said ABF in a trading statement.“Sales were 1% ahead of last year for the period, in a market which declined year-on-year.” In what the British Retail Consortium called the worst Christmas for the highstreet this decade, the news comes as light relief with Debenhams (LON:DEB) and Marks and Spencer (LON:MKS) reporting a drop in sales, while Tesco (LON:TSCO) and John Lewis (LON:JLH) had a comparatively positive festive period. ABF noted similar trends to its counterparts, with consumers opting for online outlets for discounts in November. Primark has been able to capitalise on the highstreet by undercutting its rivals and has actually benefited by expanding its physical presence on the continent and its retail space in the UK. For the 16 weeks to the 5th of January, Primark sales were up 4%, while sales for ABF as a whole rose 2% on-year.

What analysts are saying about Primark

Investment director for Fidelity Personal Investing’s share dealing service, Tom Stevenson, said, “Without a strong online business […] Primark has to rely on under-cutting its fast fashion rivals to maintain its lead on the struggling High Street. “Today’s third-quarter trading update suggests it is continuing to grab market share, with sales in the core UK business up 1% compared with a declining market overall.” He added that “Primark is winning share without having to sacrifice margin.” Not only has it achieved this, but expansion is still on the horizon. “In the UK, we relocated to larger premises in Harrow and the Merry Hill store was extended,” ABF said in a trading update.“Our 160,000 sq ft store in Birmingham is expected to open in April.”Hargreaves Lansdown Equity Analyst Sophie Lund-Yates weighed in: “ABF’s crown jewel is still Primark, and it’s managing to shine through a pretty muddy high street environment.” “Primark just needs to keep doing what it’s doing – opening new stores is clearly working, even if doing so seems like a brave move in a rocky retail climate. All-in-all, Primark’s in a position some of its rivals can only dream of.”

Primark as it stands

While ABF has been described as ‘sour sugar’, Primark have consistently offset the shortfalls by its other subsidiaries. ABF shares are currently trading at 2,300p a share 17/01/19 (1315GMT), up 122p or 5.60% since markets opened. Analysts from Shore Capital, Liberum Capital, HSBC and UBS have all reiterated their ‘Buy’ stance on ABF stock.CyanConnode revenue jumps significantly on Nordic and Indian growth

CyanConnode (LON:CYAN) released a positive trading update on Thursday pointing to significantly higher revenues in 2018, propelled by organic growth in India and the Nordics.

CyanConnode facilitates Internet of Things (IoT) communications with their RF mesh communications technology.

The company have enjoyed higher revenue from a $18.9m Indian order for CyanConnode’s OmniMesh solution. $4m of this order has been recognised in the full year to 31st December 2018 helping revenue rise 400% on 2017FY.

The OmniMesh solution was launched in June 2018 to provide efficiencies in the electricity smart metering.

Smart Metering functionality can assist the distribution of electricity on periods of enhanced demand.

John Cronin, CyanConnode Executive Chairman, commented:

“Meaningful progress has been made during 2018 and I anticipate further progress during 2019. I would like to thank shareholders for their continued support including their further capital investment. I would also like to thank all our staff for their dedication and efforts during the year.”

In addition to the promising growth in India and the Nordics, Cyanconnode has recently signed a license agreement with Chinese based Jingybeifang Instrument Co. Ltd. The agreement licenses the use of CyanConnodes in smart meters.

The deal is reported to be worth $4m and set to commence in the second half of 2019 providing the opportunity for another year of significant top line growth for CyanConnode.

Brexit: an imperfect storm

This piece is by no means factual, nor is it exhaustive or representative of the views of my peers. It is simply my unenlightened take on what Brexit means for the way we look at our Parliament, and I reserve the right to change my mind.

Brexit has underlined some of the systemic shortcomings in Westminster, by being one of the first instances of ‘politics’ in the modern era. While this sounds both cryptic and contentious, Westminster has – in the decades from Thatcher to present day – descended from a forum for political debate into a sphere of centrist amelioration politics and ultimately the politics of problem-solving and economic stewardship. What Brexit has done is given the political establishment an issue where the centre-ground doesn’t hold primacy – and doesn’t provide a basis for national unity – and thus the regular approach of compromise and fudging a solution, pales in the face of an issue where warring ideological factions are innate.

Why Westminster loves a perfect storm

While it is easy to imagine that centrist or problem-solving politics would lend itself to favouring political, social and economic calm – with politicians assuming a quasi-caretaker role – this does not mean that political turbulence is entirely counterproductive. Indeed, the public has more education, access to information and the ability to voice their concerns, than ever before. Thus, it is easy to imagine that in times of calm, the elevated and esteemed role of the political class appears to some to be almost arbitrary, and far more reactive than proactive. As such, instances of crisis management spanning from the control of money supply under Thatcher’s first term of office, to Cameron’s fiscal retrenchment during the most recent recession, almost serve to cement or legitimise the view that Parliament plays a role as a guiding hand or voice of reason within the body politic. A view which, of course, the Brexit debacle has gone some way to debunking.Why Brexit is different

Brexit is different, and there are many reasons for this. For the sake of keeping this article concise, we will only address one – rifts both within Parliament and in wider society. In what has been a widely covered display of incompetence, I hope readers can spare some hollow laughter for the Tory party as it attacks itself and forgets how to do what it does best, which is – loosely – governing effectively and managing the status quo. Following a vote and the resulting tumult the party brought upon itself, Theresa May’s thinly-veiled blackmail of ‘vote for my deal or risk no deal’ falls into the highlight reel and we can only remember with fondness such thin veneers of effective leadership as the mantra ‘strong and stable’. Sadly, her opposite number offers little relief, with more than thirty years of ideological stubbornness teetering at the first whiff of political gain. Unfortunately, even in televised PMQs, Jeremy Corbyn has managed little more than weak punches against an opponent with their hands down. While incompetence and division in the Commons has been well-documented, it is at best a reflection of the main issue – our inability to put a lid on the divisions Brexit has highlighted in wider society. As rightly stated by a host of commentators, Brexit proceedings have brought sentiments of intolerance to the fore; and while this is regrettable, these views are not new. Until 2016, the discourse surrounding immigration and inter-cultural friction existed on the fringes but have largely been viewed as a faux pas by the political mainstream. This represents one of two shortfalls, either that politicians are out of touch with the salient issues that pervade general society, or until they have hand forced, the importance of innately contentious issues are regularly understated on the political agenda. Whether because of ignorance, or merely because they live in hope, our representatives in Westminster appear to actively peddle a sort of pan-London model of society onto the whole of the UK – one where a loosely cobbled together idea of national identity is built upon celebrating diversity. Perhaps then, what Brexit proceedings have inconveniently highlighted is that this idea is disturbingly off the mark. Westminster’s London-centric approach and attempts to speak a national sense of community into being, have been called into question by a new dialogue which exposes the often-patronising bombast of the privileged, moneyed and regularly centrist London cohort, who do not represent the views of the country at large.The tragedy of Brexit

The last two years have seen the debate touch the nerves of deep-rooted social issues, though these issues have failed to achieve primacy. While one argument states that the Leave camp won on the back of public disillusionment and people feeling they were being denied a say on anything that actually matters – what Brexit proceedings have guaranteed is no substantive discussion of anything BUT Brexit for two years. What we have now are deeper social rifts, economic and political uncertainty, and an effective distraction from talking about problems that existed in Britain before Brexit reared its head. Within Parliament, what we have uncovered is our politicians’ apparent inability to contend with matters that are innately political, beyond issues of monetary and fiscal policy.Ten opportunities 2 double in 2019: First two recommendations by Jon Levison

Our veterans know the ground rules, we pick the companies you do the trading. Our guideline is that if our tip has not worked within 3 months, unless it is specifically deemed to be longer-term, it may be best to sell and redeploy the funds.

These Opportunities 2 Double are different. We feel confident that our experience of recognising the financial and non-financial patterns in a company’s business cycle we have identified Ten great unrecognised opportunities.…..

If, however there was no risk it would not be a market. So please get comfortable with the degree of financial risk, which we do explain. Then consider if you agree that the blue-sky element of the business risk is sufficiently real and large for the company to double in price. We suggest selling half your shares if they double and will report any changes of mind. We are looking forward with some excitement in publishing the recommendations over the coming weeks.

This week we are publishing the first two.

____________________________________

TechFinancials (LSE:TECH)

4.9p (4.3p/5.5p)

Mkt Cap: £4.17m

Next results: Finals, June

TechFinancials (LSE: TECH) is moving its focus from a CFD trading technology business into blockchain technology. It has two blockchain projects. One is a diamond exchange platform and the other, more interesting, project is a blockchain-based sports ticketing business. The signing up of the first football, or other sports, club and outside investment should provide upward momentum for the share price.

TechFinancials is developing the ticketing venture with Footies Tech Ltd. The new company will licence the blockchain technology from TechFinancials, which will hold a 75% stake in the venture. TechFinancials will inject up to $500,000 into the company, as long as a client is signed up. Former Liverpool FC chief executive Ian Ayre will be chairman of the new company.

The idea is to use blockchain technology to enable the sports club to take control of the initial sale and any secondary ticket transactions. Because the ticketing is fully digital it will remove ticket touts and highly inflated prices from the equation. Tickets can be sold via the platform and the club will take a share of any profit over the ticket price. The club can also track attendance and make specific merchandise offers to fans.

A football club is likely to be the first to take up the platform, but it can be used for other sports clubs.

Assuming the first club is signed up in the first quarter then the roll-out should be after May but ahead of the new football season. There will be a set up fee, an annual service fee and a fee for each transaction.

The venture will need to raise further funds and it is likely to seek VCT investment. Depending on the pricing of any share issue, that could provide an uplift in the valuation of TechFinancials stake.

TechFinancials record is poor, although there is cash in the bank, and this investment is speculative. However, the potential for the ticketing technology is enormous and as long as the project shows that it is making progress then this will spark interest from investors and push up the TechFinancials share price.

Buy.

__________________________________

Hardide (LSE: HDD)

1.3p (1.25p/1.35p)

Mkt Cap: £22.3m

Next results: Interims, May

Hardide (LSE: HDD) is a very different company to TechFinancials because it already has a growing business, even if it has been loss-making. Hardide has developed coatings technology that can uniformly cover difficult shapes – inside and out – using chemical vapour deposition. Wear resistance is 250 times greater than steel.

Revenues have historically been dominated by the oil and gas sector, but aerospace should become an increasingly important client sector over the next few years.

A slump in demand from oil and gas customers hampered progress at Hardide, which has facilities in the UK and US, in recent years. The US generated 61% of revenues last year, so Hardide is not dependent on the UK economy. There is also increased value added on some contracts where Hardide is responsible for the manufacture, not just coating, of a part.

Aerospace companies have been testing the coatings on parts for aircraft and helicopters, but this has been a long, drawn out process. Airbus has agreed technical details for a range of components and it is a case of coming to a commercial agreement.

Leonardo Helicopters is getting to the point of part approval on a transmission system. There are other firms assessing the effectiveness of the coatings. The UK and US facilities have gained aerospace accreditation, so they are ready for orders.

The third US reactor was commissioned before the end of 2018 and a new pre-treatment line will be installed this year. There are capacity and space restrictions in the UK, so further investment on the current or a different site will be required.

Hardide is on course to move into profit in 2019-20 as oil and gas demand continues to recover and other sectors should grow revenues. There was net cash of £3.2m at the end of September 2018, but this will decline as further capital investments are made. One concern is that Hardide will require more cash in order to invest in further additions to capacity.

There is a good chance that the first aerospace orders will come through this year and this will significantly increase the potential for Hardide. Timing is difficult to predict so some patience may be needed.

Buy.

These tips were produced by John Levison for his OMG newsletter

Funding Circle ends 2018 ahead of expectations

Leading small and medium enterprise lending company, Funding Circle, has posted its fourth quarter results on Thursday, topping expectations.

For the three months to 31 December 2018, full-year revenue growth came in at 55%, exceeding the 50% guidance stated at the company’s IPO.

Loans under management totalled £3.1 billion, a 55% increased compared to the same period year earlier. This figure also exceeds the IPO expectations.

Total organisations were up 40% to £2.3 billion. Revenue growth exceeded organisation growth in the second half of 2018. This is as a result of policy changes for existing borrowers in the US, reducing overall organisations by leaving revenue untouched.