Study finds how generous parents are at Christmas

President of Stenn: Boris to provide UK with “much-needed solidity”

Regency Mines reflect on tough financial trading year

Regency mines Plc (LON:RGM) have seen their shares plummet on Friday after the firm reflected on what was a tough year.

Regency Mines plc is a small cap natural resource exploration and development listed company on the Alternative Investment Market of the London Stock Exchange Ltd in London.

The firm reflected back on what seemed to be a modest year for the firm, as it reported a widened loss in its recently ended financial year.

The company reviewed the financial year by saying it was “difficult and disappointing”.

The firm yesterday said that it will be buying out the remaining shareholders in its UK energy storage business, Allied Energy Services business.

These shareholders hold a 20% stake in Allied Energy, where as Regency Mines hold an 80% stake.

For the sale of the remaining 20%, the minority shareholders will be issued 2.5 million shares in the company, following the 1 for 100 share consolidation, which is expected to take place on Tuesday next week.

For the financial year, Regency reported a pretax loss of £2.6 million which was widened from £1.5 million the year before, a stat that will worry shareholders.

The firm said that this was mainly due to a one-off gain of £1.5 million from a disposal in the 2018 financial year, more than offsetting higher impairment charges.

Additionally, the loss was widened due to a written of investment in joint venture firm Mining Equity Trust LLC which was unable to continue coal production in the US due to a shortage of funds.

There was also the write-off of the company’s investment in White Car Ltd, which entered voluntary liquidation in June, and funding constraints limiting progress in the Dempster vanadium project in the Yukon, Canada.

Regency speculated that it expects to end 2019 with firmer foundations, following proposed fundraising, debt restructuring, share consolidation and change in board.

All these strategies however will be approved at their general meeting next week.

Shares of Regency Mines plummeted 14.13% on the announcement to 0.032p. 20/12/19 11:12BST.

Regency’s Share Placing Plan

The firm announced at the start of December that it would be conducting a share placing plan as part of a company restructuring program.

Regency has proposed to raise £831,000 via a placing of 3.02 billion new shares at a price of 0.0275p each. Alongside the placing, an additional 530.0 million shares, representing obligations of £145,785, have been issued to Red Rock Resources PLC (LON:RRR) in “full extinguishment of outstanding obligations”.

The share placing plan meant that the company will have 8.69 billion shares in current issue.

Regency also said that C4 Energy Ltd, a UK incorporated private company, part controlled by proposed new chair James Parsons, has secured an option to acquire Regency’s remaining debt.

Regency concluded that partial conversion of f promissory notes will result in the issue of 2.60 billion shares, while holders of £281,113 in outstanding convertible loan notes have agreed to convert these into 1.02 billion shares.

Certainly, this has been a tough time for Regency Mines, and shareholders will hope that 2020 can bring some good results following pledges to overhaul operations and management.

Fine Wine Investment Report 2019

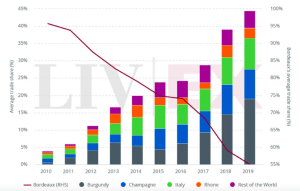

A broader marker of fine wine performance is the Liv-Ex trading platform which is one of the world’s most important fine wine marketplaces. The value of live bids and offers on Liv-Ex hit a record high of over £70 million at the end of July, up from the 2018 high of £50 million. Fine wine trading is thriving like never before thanks to ever-growing demand from Asian consumers and the current economic climate driving interest from international investors.

Along with growth has come continued market diversification. In October the United States introduced hard-hitting new tariffs on wines from France, Spain, and Germany with an ABV of 14% or below. Since the tariffs were introduced Italy and Champagne have already seen their average market share grow to 11% according to Liv-Ex. The Rest of the World index has also benefited, rising from a year-to-date average of 5% to 9% in November. The main loser in this trend of diversification has been Bordeaux, traditionally known as the wine collector’s favourite, with market share falling to an all-time low of 45% in August.

For the year ahead investors can expect the trend of diversification to continue and perhaps even gather pace dependent on the U.S. government’s plans to introduce further tariffs. In December the Office of the US Trade Representative (USTR) recently revealed proposals to impose tariffs of “up to 100%” on certain French goods including Champagne and other sparkling wines.

This warning from the USTR comes in response to a WTO ruling on EU subsidies illegally paid to Airbus; “In light of today’s report and the lack of progress in efforts to resolve this dispute, the United States is initiating a process to assess increasing the tariff rates and subjecting additional EU products to the tariffs”.

If the U.S. government does decide to follow through on these threats, we can expect to see continued movement towards alternative wine regions like Tuscany, Barolo, and Napa Valley. Italy has for now escaped the imposition of tariffs and is already the leading exporter of wine to the US. These well-established routes to market and consumer familiarity will provide a strong foundation for future growth as the fine wine market adapts to the new realities of 2020.

A broader marker of fine wine performance is the Liv-Ex trading platform which is one of the world’s most important fine wine marketplaces. The value of live bids and offers on Liv-Ex hit a record high of over £70 million at the end of July, up from the 2018 high of £50 million. Fine wine trading is thriving like never before thanks to ever-growing demand from Asian consumers and the current economic climate driving interest from international investors.

Along with growth has come continued market diversification. In October the United States introduced hard-hitting new tariffs on wines from France, Spain, and Germany with an ABV of 14% or below. Since the tariffs were introduced Italy and Champagne have already seen their average market share grow to 11% according to Liv-Ex. The Rest of the World index has also benefited, rising from a year-to-date average of 5% to 9% in November. The main loser in this trend of diversification has been Bordeaux, traditionally known as the wine collector’s favourite, with market share falling to an all-time low of 45% in August.

For the year ahead investors can expect the trend of diversification to continue and perhaps even gather pace dependent on the U.S. government’s plans to introduce further tariffs. In December the Office of the US Trade Representative (USTR) recently revealed proposals to impose tariffs of “up to 100%” on certain French goods including Champagne and other sparkling wines.

This warning from the USTR comes in response to a WTO ruling on EU subsidies illegally paid to Airbus; “In light of today’s report and the lack of progress in efforts to resolve this dispute, the United States is initiating a process to assess increasing the tariff rates and subjecting additional EU products to the tariffs”.

If the U.S. government does decide to follow through on these threats, we can expect to see continued movement towards alternative wine regions like Tuscany, Barolo, and Napa Valley. Italy has for now escaped the imposition of tariffs and is already the leading exporter of wine to the US. These well-established routes to market and consumer familiarity will provide a strong foundation for future growth as the fine wine market adapts to the new realities of 2020. Shell cuts its oil production sales estimate within a modest quarterly update

Royal Dutch Shell Plc Class B (LON:RDSB) have given shareholders and the market a modest update on Friday.

The firm said that it can expect impairment charges off around $2.3 billion, in the fourth quarter.

Additionally, the firm trimmed its forecast for quarterly oil production sales as the firm has seen itself in tricky waters over the last few weeks.

The firm alluded to the wider macroeconomic challenges that it faces, including the ongoing feud between the Untied States and China, two of the worlds largest energy consumers.

The firm also added that it expects oil production sales o6.5 million barrels of oil equivalent per day o 7 million boepd for the fourth quarter, compared with its earlier estimate of 6.65 million boepd to 7.05 million boepd.

The company had seen a slump in its third quarter trading, did report strong oil and gas trading however. Shell said that higher taxes would be bruising earnings by $500 million to $600 million in the fourth quarter.

Post-tax impairment charges are expected to range between$1.7 billion and $2.3 billion for the quarter, Shell noted.

The FTSE 100 listed giant said it expects additional well write-offs in the range of $100 million to $200 million in the period, while 2019 capital expenditure is expected to be at the lower end of its guidance range of $24 billion to $29 billion.

Shares of Shell dipped 0.92% on the announcement to 2,251p. 20/12/19 10:20BST.

Tough times for Shell

At the end of October, Shell saw their profits sink in their third quarter update.

As profits sunk, they did however beat market and analyst expectations posting earnings of $4.8 billion (£3.7 billion), well ahead of the $3.91 billion anticipated.

Oil and Gas production for Shell fell by 1% from the same period last year to 3.6m barrels of oil equivalent per day.

In a statement, chief executive Ben van Beurden said: “This quarter we continued to deliver strong cash flow and earnings, despite sustained lower oil and gas prices, and chemicals margins.”

The oil giant have a boost in oil and liquefied natural gas compensating for offset in oil prices, which have fallen 17% year on year.

It seems that these last two quarters have been disappointing for Shell, and an ensured effort will be needed to turn fortunes around in tough trading conditions.Competitor SABIC also takes a hit

Shell joined titan rival SABIC (TADAWUL:2010) in the list of firms who had seen a slump in profits following volatile oil prices.

SABIC recorded an 86% drop in third quarter net profit after taking impairment charges off $400 million on its investment into Swiss chemicals firm Clariant.

The world’s fourth-biggest petrochemicals company posted a net profit of 830 million riyals for the quarter ended Sept. 30, down from 6.1 billion a year earlier.

“The decrease in net income is attributable to lower average selling prices in addition to recording the 1.5 billion (Saudi riyal) impairment provision,” it said.

Shells new Credit Facility – reason for optimism for shareholders

The firm also updated the market on a new credit facility, just a week ago.

The firm updated shareholders about a $10 billion new credit facility. The new facility has been agreed with a total of 25 banks and replaces the existing framework valued at $8.84 billion.

It will also, in a first, have interest and fees linked to Shell’s progress in reached its short-term net carbon footprint target. Shell has targeted reduce its footprint by 2% to 3% by 2021.

Shell has set an ambition to reduce the Net Carbon Footprint of the energy products by around 50% by 2050 and by 20% by 2035 in a time of high environmental awareness.

Bank of America and Barclays Bank acted as joint coordinators for the facility.

It seems that Shell are juggling a few issues currently as the year ends, however shareholders will have to remain optimistic.

2019 has been a year full of both political and economic tensions, with oil prices being volatile as ever.

2020 should bring some more stability for Shell, but the last two sets of quarterly results certainly will disappoint.

AstraZeneca sell two cancer drug rights for $198 million

AstraZeneca (LON:AZN) have told shareholders that they have sold two cancer drug rights for $198 million, which has seen shares spike.

Following the announcement, the firm saw its shares boosted by 1.17% to 7,723p. 20/12/19 9:50BST.

The firm updated the market on Friday by saying that it had sold the rights to drugs Arimidex and Casodex in a number of countries to Juvise Pharmaceuticals for up to $198 million.

Astra added that it had sold the commercial rights for these drugs in numerous countries which included France, Austria, Germany, Cyprus, Turkey, Morocco, Mali, and Cameroon.

Arimedex and Casodex treat mainly prostate and breast cancer, however they have recently lost their compound patent protection in the countries in which AstraZeneca sold to.

Notably, the rights to both drugs in the United States were already sold in 2017. Juvise paid $181 million upfront to AstraZeneca, and may make additional sales dependent payments up to a total of $17 million.

In 2018, Arimidex saw sales of $37 million in the countries covered by the new agreement, while Casodex sales were $24 million.

These divestments will not alter Astra’s 2019 financial guidance, it said, and any income from the upfront and future payments will be reported in Astra’s financial statements under “other operating income & expense”.

Dave Fredrickson, Executive Vice President, Oncology Business Unit, said: “Arimidex and Casodex are important established medicines and we are pleased that Juvisé Pharmaceuticals will now take on the work of making sure patients continue to have access to them. Today’s agreement is part of a broader strategy of reducing our portfolio of mature medicines to reallocate resources towards developing our pipeline of new medicines.

Deepmatter Partnership

Last week, Deepmatter Group PLC (LON:DMTR) saw their shares rally following a pharmaceutical technology collaboration with AstraZeneca.

Deepmatter joined forces with the FTSE 100 giant in a digital technology venture, designed to speed up the drug delivery process.

Michael Kossenjans, an associate director at Astra’s Discovery Sciences, Research & Development unit, said: “Our goal is to transform drug design using innovative digital technologies in combination with automation and artificial intelligence. To get potential new medicines to patients faster, we need to reduce the cycle time for lead identification and optimisation and look forward to working with DeepMatter to assess the potential of DigitalGlassware to help with this.”

It seems that following last weeks partnership, AstraZeneca have once again pulled it out of the bag today, and certainly shareholders will be impressed, as the firm continues to grow and diverse.

AstraZeneca continues to expand into China

Additionally, Astra have continued to expand into the global pharmaceuticals market. The firm noted just over a fortnight ago that it had received a marketing approval for two different drugs.

Astra told shareholders that they had joined forces with Merck & Co (NYSE:MRK) to receive marketing authorization from China’s National Medical Products Administration for their Lynparza drug.

The company said Lynparza, which is being jointly developed and commercialised by AstraZeneca and Merck, is currently approved in 65 countries, including the EU, US and Japan. China has the highest prevalence of ovarian cancer globally, with more than 52,000 new cases diagnosed in 2018.

Finally, shareholders got the icing on the cake. When Astra said that they would create a new global research and development centre n China.

There was an ensured effort from Astra to create both a research centre and am artificial intelligence innovation center both in Shanghai, and a “first-of-its-kind” healthcare industrial fund with China International Capital Corp Ltd (HKG:3908).

Aviva announce George Culmer as Senior Independent Director

Aviva plc (LON:AV) have announced today that they have appointed their Non-Executive Director to senior independent director effective from the start of next year.

George Culmer is set to take the role on, and should be something that shareholders take with optimism as 2019 closes.

Shares of Aviva Trade at 420p (-0.25%). 20/12/19 9:38BST.

The FTSE 100 listen firm said that Culmer will take on the reigns from Glyn Barker whose retirement from the board at the end of this year was announced earlier this month.

Culmer joined Aviva’s board as a non-executive director back in September.

He is also a non-executive director at jet engine maker Rolls Royce, and held previous roles including being chief financial officer at Lloyds and at RSA Insurance Group.

Aviva Chair Adrian Montague said: “George brings significant board level experience, having spent 15 years as a FTSE 100 chief financial officer, and has a deep understanding of insurance and wider financial services.”

Management changes for Aviva?

Aviva at the start of December announced that they would be appointing Amanda Blanc as independent non executive director.

Blanc will take the position, following her appointment as the first women chair of the Association of British Insurers in 2018.

The move will take place from January 2nd, and shows a constructive move by Aviva to stimulate business.

Blanc has vast experience in the industry, having been the former boss of AXA in their UK and Irish division, additionally she has worked at Zurich Insurance Group, and held senior management positions at Towergate Insurance Brokers, Groupama Insurance Company and Commercial Union.

The move to make these appointments in quick succession comes at a time where global trading has been tough, and Aviva are looking to combat this.

Asian Difficulties

Aviva have seen a tougher trading period, particularly in Asia where the firm has made an active effort to promote their operations.

On November 18, the firm made an announcement saying that it was determined to turn its Singapore operations around.

The big insurance firm reported that it had looked at selling off the business, after the board confirmed that offers had been received.

“Aviva’s Singapore and China business units delivered double digit operating profit growth in 2018 and are earning attractive returns. Both countries are expected to pay dividends to group centre in 2019,” the company said in its statement on November 18.

A couple days after this, thee firm saw its shares dip as it gave shareholders an update on its business in Hong Kong.

Shares dipped almost four per cent, saying that it was planning to review its Hong Kong operations.

The insurance firm said it will simply its business structure into five operating divisions and sell its stake in the Hong Kong business to co-investor Hillhouse Capital.

With Hong Kong currently being in both political and economic turmoil, there is no surprise that these results worried shareholders.

Aviva set targets for the next three years. The highlights being a 12% return on equity, a £300 million net cost saving and an aim to generate a cash flow between £8.5 billion and £9.5 billion.

Certainly, shareholders should be pleased with the internal appointment, as Aviva seem to be making an ensured effort to carry optimism going into 2020.