Coronavirus: Over 12,000 jobs lost in two days

John Lewis to close stores and cut jobs

Sainsbury’s sales surge but higher costs subdues profit outlook

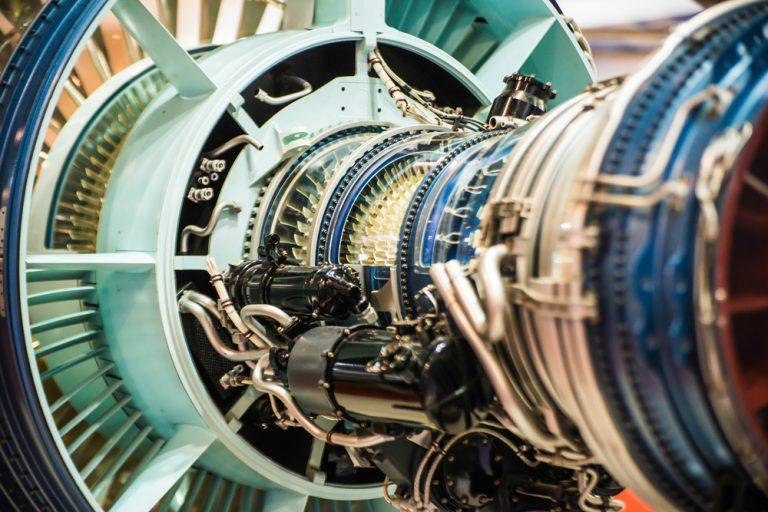

Airbus to cut 1,700 UK jobs

UK Investor Magazine Virtual Investor Presentation 30th June

Speakers and Presentation Downloads

Roger Hardman – Investor and Founder of Hardman & Co Andrew Hore – Editor, AIM Journal To view PDF presentation, please click here John Cronin – Executive Chairman, CyanConnode To view PDF presentation, please click here Martin Sherwood – Development Director, Kin Capital To view PDF presentation, please click here Jon Levinson – Corporate Broker, SI CapitalBoris encourages home building by deregulating brownfield development

Hooray for less red tape, or nay for lower-quality living?

One issue that has been raised with this approach is that fewer regulations naturally encourage lower standards. Tom Fyans, policy and campaigns director at CPRE, the countryside charity, said that encouraging brownfield development decreases the pressure on greenfield sites. However, he also said that: “Deregulating planning and cutting up red tape simply won’t deliver better quality places. It’s already far too easy to build poor quality homes. Our research has shown that three quarters of large housing developments are mediocre or poor in terms of their design and should not have been granted planning permission. “The best way to deliver the places that we need, at the pace we need them, is to make it easier for local councils to get local plans in place, and then to hold developers to those plans.” Further, Deputy Editor of Inside Housing, Peter Apps, added:One safeguard Boris Johnson was willing to put in place was that pubs, libraries and village shops will be exempted from the brownfield and conversion schemes announced on Tuesday, as the government view these as “essential to the lifeblood of communities”.Cut this and you get worse housing developed for less and sold for more, not necessarily faster build out. If you want faster build out, you need a blend of tenures (rental, sale, social). Ironically, his focus on ‘getting people on the housing ladder’ pushes that back.

— Peter Apps (@PeteApps) June 30, 2020

More homes or just more properties?

Another issue we might take with today’s announcement is that house building and home ownership are not always consistent. While building something like 250,000 new homes a year is an admirable goal, the reality is that many of these will inevitably end up as additions to a portfolio and on the private rental market. We can argue whether this is a bad thing or not, but to claim that new ‘homes’ are being built at a rapid rate may be misleading. As Economist Paul Collier stated, home ownership increased exponentially to around 70% in 1980, and since then it has exponentially decreased. To increase home ownership, we need not only to build property but to make it easier for first time buyers to get on the ladder. In Boris Johnson’s defence, this concern was represented by a new feature called “First Homes” scheme, which is a new pilot programme of 1,500 new homes which will be sold exclusively to first-time buyers for a 30% discount. Further, the government pledged to commit £12 billion to an 180,000 affordable homes programme over the next eight years, though this is a notable backtrack on the previous five-year plan for £12.2 billion-worth of expenditure. As stated by Shadow Business Secretary Ed Miliband: “So now we discover this ‘FDR’ speech cuts money for affordable housing -£12bn over 5 years in Budget 2020, now £12bn over 8 years. What an absolute fraud.”What do we think?

It’s rather a mixed bag to be honest. The new rules will come into effect by September, once changes to planning laws have been ratified. The building of new homes should always be encouraged, though a greater commitment to encouraging first-time buyers would have been more in keeping with Boris Johnson’s trademark national potential and opportunity rhetoric. As far as the online response is concerned, so far comments on more ‘left-wing’ outlets have lamented the announcements, while comments on more ‘right-wing’ outlets have expressed concerns about over-building and the damage this could cause to communities and ecosystems, with others asking the prime minister to limit immigration rather than housing supply, to deal with the demand for new homes.AstraZeneca shares slip despite new Japan orphan drug designation

AstraZeneca said that selumetinib is developed and commercialised in partnership with Merck and Co. (NYSE:MRK), and that the treatment would help those experiencing plexiform neurofibromas as a result of NF1.

Speaking on the condition, José Baselga, Executive Vice President, Oncology R&D, said:

“Neurofibromatosis type 1 can have a devastating impact on children and new medicines are urgently needed to help treat the resulting plexiform neurofibromas and associated clinical issues. Current options in most countries are limited and this designation is a significant step forward in bringing the first medicine for NF1 to paediatric patients in Japan.”

Roy Baynes, Senior Vice President and Head of Global Clinical Development, Chief Medical Officer, MSD (Merck) Research Laboratories, said on the new treatment:

“Plexiform neurofibromas are one of the key manifestations of NF1 and can lead to pain and disfigurement. In the SPRINT trial, selumetinib was shown to reduce the size of these tumours in children. We are hopeful that we will be able to bring this treatment to this underserved paediatric patient community in Japan.“

The plexiform neurofibromas tumour grows along a patient’s nerve sheaths, and can cause issues such as disfigurement, motor dysfunction, airway dysfunction, visual impairment and bowel and bladder dysfunction. The selumetinib treatment, when trialled, reduced tumour volumes by at least 20% in 66% of the NF1 patients it was tested on (33 out of 50). Today’s ODD by The Japanese Ministry of Health, Labour and Welfare means selumetinib will be added to the list of medicines used for the treatment of rare conditions. ODD is a classification designated for treatments for diseases that affect fewer than 50,000 patients in Japan, for which, AstraZeneca says, “there is a high unmet need”.Despite the seemingly positive update, AstraZeneca shares dipped by over 1.20%, before recovering slightly to a 0.99% dip, to 8,463.00p per share 30/06/20 12:34 BST. This is up frm the company’s year-long nadir of 6,221.00p in mid-March, but down from its 9,004.00p high in mid-May. The company’s p/e ratio is 102.15p, its dividend yield is modest but reliable at 2.58%.

Smiths Group shares rally on ‘resilient’ COVID trading

The company said that its performance over the last four months was driven by its strong order books at the start of the pandemic, and the overall momentum of first half trading. It did note, however, that there had been some slowing down, with its customers and operations impacted by COVID. It said that it was currently operating at all 75 of its plants but was not immune to higher consequential costs.

Throughout its divisions, Smiths Group stated that; John Crane still booked year-to-date revenue growth, Smiths Detection performed strongly due to delivery of original equipment programmes, Flex-Tek performs well though its aerospace and Smiths Interconnect has had its revenues impacted, though orders and revenues have both recently improved.

In addition, the company noted that Smiths Medical saw underlying revenue growth of 2% in the second half, alongside year-to-date revenue growth of 1%. While the division’s non-COVID procedures suffered, demand for critical care restocking was strong.

Further to its trading update, the company also announced that it would be undertaking a restructuring plan to maintain its strong performance after the virus, and help it to deliver its operating margin goal of 18-20%. The programme will be group-wide, with a £65 million operating cost split between FY2020 and FY2021. Smiths Group said the restructuring would substantially offset costs in FY2021 and deliver the full annualised benefit of £70 million in FY2022.

Smiths Group response

Company Chief Executive Andy Reynolds Smith commented on the results:“ Market-leading positions and a flexible business model have enabled the Group to continue to perform through crisis disruption.”

“Our immediate focus is the safety of our people and business continuity for our customers. We will continue to take the actions necessary to safeguard our long-term competitiveness. I very much regret that this will result in some job losses. My sincere personal thanks go to the amazing Smiths employees around the world for their dedication and commitment.”

“The Group has a resilient business model; market-leading positions, a culture of innovation at its heart, combined with relentless execution. We are confident that we will meet the challenges of the current crisis – and emerge stronger, better able to outperform long-term.”