AstraZeneca shares slip despite new Japan orphan drug designation

AstraZeneca said that selumetinib is developed and commercialised in partnership with Merck and Co. (NYSE:MRK), and that the treatment would help those experiencing plexiform neurofibromas as a result of NF1.

Speaking on the condition, José Baselga, Executive Vice President, Oncology R&D, said:

“Neurofibromatosis type 1 can have a devastating impact on children and new medicines are urgently needed to help treat the resulting plexiform neurofibromas and associated clinical issues. Current options in most countries are limited and this designation is a significant step forward in bringing the first medicine for NF1 to paediatric patients in Japan.”

Roy Baynes, Senior Vice President and Head of Global Clinical Development, Chief Medical Officer, MSD (Merck) Research Laboratories, said on the new treatment:

“Plexiform neurofibromas are one of the key manifestations of NF1 and can lead to pain and disfigurement. In the SPRINT trial, selumetinib was shown to reduce the size of these tumours in children. We are hopeful that we will be able to bring this treatment to this underserved paediatric patient community in Japan.“

The plexiform neurofibromas tumour grows along a patient’s nerve sheaths, and can cause issues such as disfigurement, motor dysfunction, airway dysfunction, visual impairment and bowel and bladder dysfunction. The selumetinib treatment, when trialled, reduced tumour volumes by at least 20% in 66% of the NF1 patients it was tested on (33 out of 50). Today’s ODD by The Japanese Ministry of Health, Labour and Welfare means selumetinib will be added to the list of medicines used for the treatment of rare conditions. ODD is a classification designated for treatments for diseases that affect fewer than 50,000 patients in Japan, for which, AstraZeneca says, “there is a high unmet need”.Despite the seemingly positive update, AstraZeneca shares dipped by over 1.20%, before recovering slightly to a 0.99% dip, to 8,463.00p per share 30/06/20 12:34 BST. This is up frm the company’s year-long nadir of 6,221.00p in mid-March, but down from its 9,004.00p high in mid-May. The company’s p/e ratio is 102.15p, its dividend yield is modest but reliable at 2.58%.

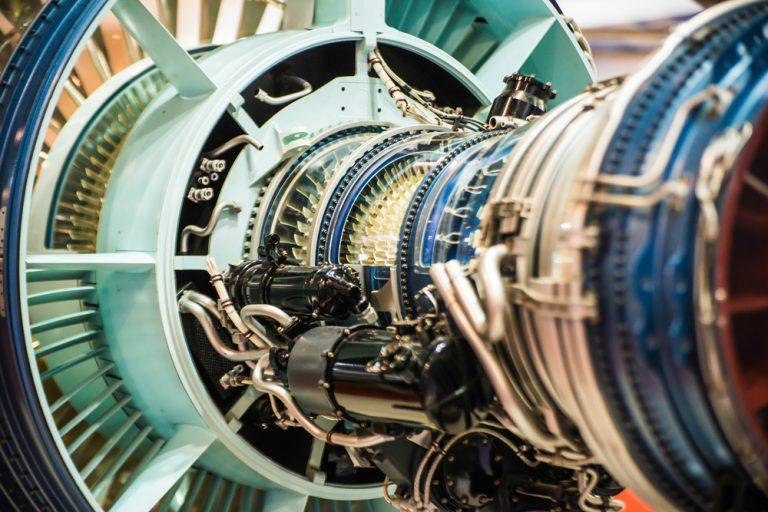

Smiths Group shares rally on ‘resilient’ COVID trading

The company said that its performance over the last four months was driven by its strong order books at the start of the pandemic, and the overall momentum of first half trading. It did note, however, that there had been some slowing down, with its customers and operations impacted by COVID. It said that it was currently operating at all 75 of its plants but was not immune to higher consequential costs.

Throughout its divisions, Smiths Group stated that; John Crane still booked year-to-date revenue growth, Smiths Detection performed strongly due to delivery of original equipment programmes, Flex-Tek performs well though its aerospace and Smiths Interconnect has had its revenues impacted, though orders and revenues have both recently improved.

In addition, the company noted that Smiths Medical saw underlying revenue growth of 2% in the second half, alongside year-to-date revenue growth of 1%. While the division’s non-COVID procedures suffered, demand for critical care restocking was strong.

Further to its trading update, the company also announced that it would be undertaking a restructuring plan to maintain its strong performance after the virus, and help it to deliver its operating margin goal of 18-20%. The programme will be group-wide, with a £65 million operating cost split between FY2020 and FY2021. Smiths Group said the restructuring would substantially offset costs in FY2021 and deliver the full annualised benefit of £70 million in FY2022.

Smiths Group response

Company Chief Executive Andy Reynolds Smith commented on the results:“ Market-leading positions and a flexible business model have enabled the Group to continue to perform through crisis disruption.”

“Our immediate focus is the safety of our people and business continuity for our customers. We will continue to take the actions necessary to safeguard our long-term competitiveness. I very much regret that this will result in some job losses. My sincere personal thanks go to the amazing Smiths employees around the world for their dedication and commitment.”

“The Group has a resilient business model; market-leading positions, a culture of innovation at its heart, combined with relentless execution. We are confident that we will meet the challenges of the current crisis – and emerge stronger, better able to outperform long-term.”

Investor insights

Following the update, Smiths Group shares rallied significantly by 7.74% or 100.50p to 1,398.50p per share 30/06/20 11:59 BST. The company is still rated as a ‘Strong Buy’ or ‘Buy’ in most analysts’ eyes. The median price target is 1,450.00p a share, while its share price at the start of trading on Tuesday, was down 11.09% year-on-year. Th company has a p/e ratio of 18.98 and a dividend yield of 3.30%.On the Beach reports 66pc fall in revenues

Wirecard UK ban lifted, allowing customers to access cash

Byron Burger seeks buyer as it teeters on the brink of administration

EQTEC shares surge on JV announcement, up over 500% in 2020

“Developing partnerships with high quality and established stakeholders in our target markets has been a key focus of EQTEC since I joined the company,” said David Palumbo, CEO of EQTEC.

“We are particularly excited about this collaboration agreement with Carbon Sole as we rarely find a developer with such a great understanding of the sector matched with a thorough understanding of the energy needs of the towns and available resources in which the projects are to be vested.”

“Carbon Sole have made numerous public sector presentations and submissions towards the decarbonisation of gateway towns and regions, including actively participating in public sector stakeholder steering groups and workshops in respect of Renewable Supports and Climate Action Funding.”

“Carbon Sole have been advising both public and industrial sectors in Ireland on the decarbonisation of industrial processes and energy transition for a number of years. We enter this partnership very confident that it will evolve beyond the current three projects under development.”

“Ireland is a very interesting market for us, offering numerous opportunities, particularly given its unique characteristic of being now the only EU state in the islands of the North Atlantic. It is also the location of our corporate headquarters and we intend to be a significant player in the decarbonisation process of its industries.”

“Developing partnerships with high quality and established stakeholders in our target markets has been a key focus of EQTEC since I joined the company,” said David Palumbo, CEO of EQTEC.

“We are particularly excited about this collaboration agreement with Carbon Sole as we rarely find a developer with such a great understanding of the sector matched with a thorough understanding of the energy needs of the towns and available resources in which the projects are to be vested.”

“Carbon Sole have made numerous public sector presentations and submissions towards the decarbonisation of gateway towns and regions, including actively participating in public sector stakeholder steering groups and workshops in respect of Renewable Supports and Climate Action Funding.”

“Carbon Sole have been advising both public and industrial sectors in Ireland on the decarbonisation of industrial processes and energy transition for a number of years. We enter this partnership very confident that it will evolve beyond the current three projects under development.”

“Ireland is a very interesting market for us, offering numerous opportunities, particularly given its unique characteristic of being now the only EU state in the islands of the North Atlantic. It is also the location of our corporate headquarters and we intend to be a significant player in the decarbonisation process of its industries.”