UK house prices fall in January, as Brexit uncertainty looms large

UK house prices fell again in January, down 2.9% according to the latest monthly figures from Halifax.

Halifax, which is the nation’s largest mortgage lender, said this marked the second time since 2017 that the UK house prices fell at the start of the year.

The bank’s house price index figures revealed that the average house price fell to £223,691 following a 2.5% rise in December.

Ultimately, this marked the largest monthly fall since last April, when prices dipped 3.1%.

“This could either be viewed as a story of resilience, as prices have held up well in the face of significant economic uncertainty, or as a continuation of the slow growth we have witnessed over recent years,” said Russell Galley, Halifax managing director.

“There is no doubt that the next year will be important for the housing market with much of the immediate focus on what impact Brexit may have. However, more fundamentally it is key underlying factors of supply and demand that will ultimately shape the market.”

The figures follow similar downbeat numbers from the Office for National Statistics (ONS) in January.

Whilst the ONS said that UK house price growth rose to 2.8% in November, stagnation in the London property market dragged down numbers.

Specifically, London house prices fell 1.2 per cent month-on-month during the month, with the capital particularly affected by economic uncertainty and weak demand.

It is thought that many buyers have been deterred by ongoing Brexit-related uncertainty, stamp duty charges as well as expensive prices.

Cranswick Christmas revenue falls 2%, 2019 outlook subdued

Cranswick reported its results for three months to 31 December 2018, posting a 2% fall in revenue for the period.

The UK food producer said that lower sales in pork related produce were offset by more growth in its poultry and continental products.

In addition, Cranswick said it intends to invest further in its facilities to improve efficiency and increase capacities.

It said construction of its new poultry processing facility in Eye, Suffolk was on track, and expected to be completed by the end of the financial year.

The group also announced the securing of a new long-term contract with Wm Morrison Supermarkets plc to supply its poultry.

Future Outlook

Looking ahead, Cranswick said that its operating margin is likely to decline, due to a “potentially challenging commercial landscape”.

Alongside difficult trading climate, the company said that costs relating to its new facility in Eye would also impact profitability during the course of the year.

The statement added:

“Notwithstanding these short-term challenges, our new Eye and existing added value, poultry facilities and our broadening customer base, provide a solid platform to further develop our poultry business and drive future growth in this attractive and expanding protein category.”

Cranswick (LON:CWK) is listed on the London Stock Exchange. It is a constituent of the FTSE-250 Index.

Shares in the food producer are currently -15.52% as of 11:59AM (GMT).

Anglo Asian Mining gold output to fall, shares plunge

Anglo Asian Mining shares fell during Thursday morning trading after the company updated the market on its 2019 production guidance.

The gold, copper and silver miner said that it was set for “another year of delivery” in 2019, with increased copper output expected.

Anglo Asian Mining forecast metal production for the fuel year to be between 82,000 to 86,000 gold equivalent ounces (GEOs), a potential increase from the 83,736 GEOs produced in 2018.

Nevertheless, the Azerbaijan-focused company said that it expects gold production to fall between 65,000 ounces to 67,500 ounces, down from 72,798 ounces in 2018, sending shares downwards.

Anglo Asian Mining Chief Executive Reza Vaziri commented, “2019 will be another year of delivery for Anglo Asian with total metal production of between 82,000 to 86,000 gold equivalent ounces planned by our operations team. This demonstrates the sustainability of our business and builds on our record production of 83,736 gold equivalent ounces in 2018. The increasing proportion of our production as copper and gold in concentrate also highlights the versatility of our processing operations.

“One critical pillar underpinning the future growth of the Company is our ongoing exploration and development programme. Two important elements of this programme are the results of the helicopter survey and the publication of the JORC mineral resource for Gardir, our underground mine which is already in production. These are both expected to be announced in this current quarter and should further demonstrate the expansion potential of the Gedabek Contract Area.”

Anglo Asian Mining is an AIM-listed company with a 1,926 square kilometre portfolio of gold, silver and copper properties in Azerbaijan.

Elsewhere in the mining sector, Shefa Yamim shares (LON:SEFA) ticked up on Wednesday after the company updated investors on findings from a technical economic evaluation.

Conversely, Regency Mines shares (LON:RGM) fell after the company said its incoming chief executive would no longer be taking up the role.

Shares in the Anglo Asian Mining (LON:AAZ) are currently -5.81% as of 11:28AM (GMT).

Superdry blames warmer weather for weaker q3 sales

Superdry (LON:SDRY) reported its third quarter results on Thursday, blaming warmer weather for weaker sales across the period.

The retailer reported its results for the 13-week period from 28 October 2018 to 26 January 2019, noting a fall in sales.

The brand said that global revenue of £479.6 million rose by 5.4% year on year, largely due to by strong whole-sale performance.

However, group revenue was down 1.5% year on year. Superdry attributed this fall to ‘unseasonably warm weather’ throughout the quarter.

A large portion of Superdry sales are derived from its jackets, coats and hoodies, thus explaining the effect of milder weather upon profitability.

Wholesale revenue was up 12.7% to £73.5 million, compared to £65.2 million during the same period last year.

This was as a result of by forward order despatches and continued strong growth in U.S markets.

Euan Sutherland, Chief Executive Officer, commented on the results:

“Superdry’s performance has remained subdued during quarter three. We continued to be impacted by the ongoing product mix and relevance issues we have previously highlighted and by the lack, until the end of quarter three and the start of quarter four, of any prolonged period of cold weather in our key markets.

“We are pleased with the early progress being made with our transformation programme, designed to reset the business and deliver a return to higher levels of growth and profitability.”

Last year, Superdry shares took a hit after the retailer posted a 49% fall in profits for the half-year.

Once again, the brand blamed unseasonably warmer weather for the disappointing performance.

The Cheltenham-based retailer has since said it intends to shift its reliance away from winter wear as well as improving its digital presence, as it looks to revive profits in 2019.

Shares in Superdry are currently trading +0.39% as of 10:47AM (GMT).

GlaxoSmithKline profits up 36% – warnings for 2019

British pharmaceutical firm GlaxoSmithKline (LON:GSK) have posted a 36% on-year hike in full-year profits, though the company have warned investors of the potential for turbulent conditions later in 2019.

The news follows today’s announcement of a new rare disease treatment by the company’s counterpart AstraZeneca (LON:AZN), strong trade amid the FTSE slump mid-2018 and a £10 billion merger of its healthcare arm with Pfizer (LON:PFE) before the festive period.

GlaxoSmithKline positive results

GSK celebrated a 36% jump in on-year profits, which it pinned on strong sales of its shingles vaccine and respiratory disease treatments. The shingles vaccine’s sales more than doubled to £784 million, while new respiratory product sales bounced 35% to £2.6 billion. GlaxoSmithKline posted a 36% rise in pre-tax profit, underpinned higher sales of its shingles vaccine and respiratory disease treatments, but warned of lower earnings in 2019. Pre-tax profit for the year through December rose to £4.80bn, as sales climbed 2% to £30.82bn, or by 5% on a constant currency basis. “GSK delivered improved operating performance in 2018 with group sales growth, strong commercial execution of new product launches, especially Shingrix, continued cost discipline and better cash generation,” chief executive Emma Walmsley said.GSK as an investment portfolio potential

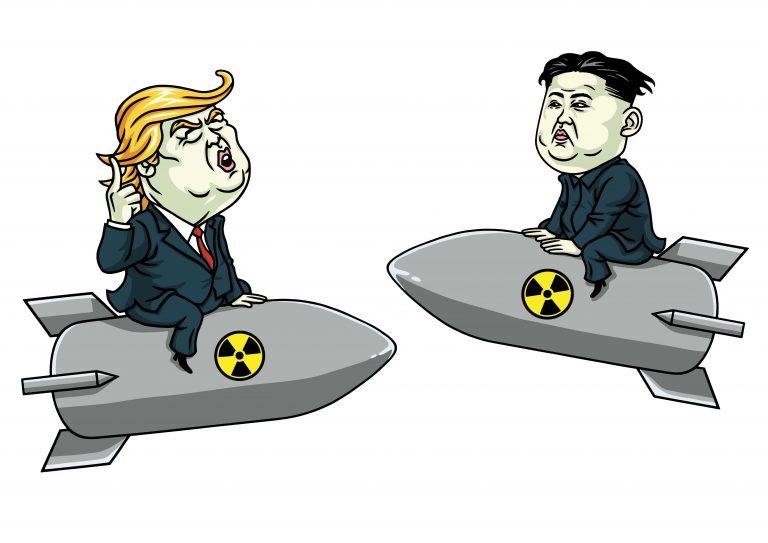

For 2019, GlaxoSmithKline predict earnings per share to fall 5-9% in constant currency, on the back of approval of a generic competitor to respiratory disease treatment, Advair, in the US. However, in the most recent results, adjusted EPS grew 7% to 199.4p or 12% on a constant currency basis. The company said this was brought about via an improved operating margin and continued financial efficiencies. The earnings guidance published by GSK also took account of the anticipated impact of their Tesaro acquisition and assumed the joint venture with Pfizer was completed without GlaxoSmithKline declared a full-year dividend of 80p per share, with a forecast for this to remain flat during the course of 2019. GSK shares are currently trading up 16.8p or 1.1% at 1,539.4p per share 06/02/19 15:17 GMT. Deutsche Bank analysts have reiterated their ‘Hold’ stance on GSK stock.Donald and Kim – summit part two

In his State of the Union address to Congress, President Donald Trump announced that he would be holding a second meeting with North Korean leader Kim Jong-un.

In the 82 minute speech, the President said he would be meeting Kim on the 27th or 28th of February, in either Da Nang or Hanoi, Vietnam.

What was said during the State of the Union?

“As part of a bold new diplomacy, we continue our historic push for peace on the Korean peninsula.” “If I had not been elected president of the United States, we would right now, in my opinion, be in a major war with North Korea,” “Much work remains to be done, but my relationship with Kim Jong-un is a good one. And Chairman Kim and I will meet again on February 27 and 28 in Vietnam.”Trump’s aim

The President hopes to build upon the relative success of last year’s summit in Singapore, and while North Korea has yet to dismantle its nuclear weaponry programme, Mr Trump stated, “our hostages have come home, nuclear testing has stopped and there has not been a missile launch in more than 15 months”. In the second instalment, the controversial US emissary will be enticed by the prospect of ending a 68-year-long conflict. Trump will inevitably seek out something more than a show of solidarity, something in the form of a written pledge. Dealing with a country known for secrecy and an introverted agenda makes North Korea a dubious dance partner, especially when the US’s chips coming into the game will largely involve dealing Kim Jong-un a more favourable hand – or plainly, lifting trade sanctions. In return for such an arrangement, Trump will no doubt be looking keenly towards his counterpart’s activities in Pyongyang and undoubtedly pushing for Kim to relinquish the Yongbyon nuclear production site.Trump and Kim from another perspective

South Korea’s Presidnet, Moon Jae-in, has already welcomed the announcement, with spokesperson Kim Eui-kyeom commenting, “The two leaders already took their first step in Singapore toward shaking off their 70-year history of hostilities. Now we hope that they will take a step forward for concrete, substantive progress,” The summit gives the leaders “the opportunity to truly make history in Vietnam. But transforming an adversarial relationship built on tough talk, nuclear threats and the danger of a second Korean war that could kill millions won’t be easy.” said Harry Kazianis, director of North Korea studies at the Center for the National Interest in Washington. “Success can only be assured in finding a formula where both sides each make concessions that are realistic, verifiable and not perceived as a loss to the one granting them.” Following the summit, President Trump has plans to meet with Chinese President Xi JinpingMosman Oil and Gas output falls behind expectations

Mosman Oil and Gas (LON:MSMN) updated the market on its production output figures for the six months to December-end.

The company said net production rose 47% in the period, compared to the first-half of the year.

Nevertheless, this proved behind previous expectations, as poor weather affected site access.

The company said that Production at its Welch site was restricted due to broken rods, as well as drilling of Stanley-2, which had been delayed as the road ‘needs to be in dry condition for the heavy rig loads’.

The firm said that its operations could continue once weather conditions had improved.

John W Barr, Chairman, said: “Mosman continues to grow its production and sales consistent with its business plan, despite the challenges of the severe weather delays, oil price falls and operational issues during the period.

“Production growth is expected to continue as workovers are completed and new wells drilled.

The horizontal wells at Welch are subject to funding, where options are being reviewed, including a farmout. Planning continues for additional wells.”

Mosman Oil and Gas is an AIM-listed oil exploration company. The firm is focused on projects in Australia and the United States.

Shares in Mosman were down 2% on the back of the announcement.

Elsewhere in the Energy sector, United Oil & Gas shares (LON:UOG) were up 2.11% as of 12:58PM (GMT), after the company updated the market on its Colter Well.

Similarly, Wentworth Resources (LON:WEN) were up 6.85% as of 12:59AM after the company exceeded its production target.

German industry touts recession: goods ‘boten’ but sinking demand

In a refreshing turn of events, Britain and Brexit are not the calling card for media woes. Today the bell tolls for the German economy, with market analysts forecasting a recession following a drastic decline in factory orders.

Was zur Hölle

While Germany may be Europe’s largest economy, and often praised for its mixed structure, its manufacturing sector has been its soft underbelly as far as the last financial year is concerned. Brexit is an obvious candidate for blame and while most pundits worry about the affects that leaving the EU will have on British trade, the reciprocity of mutually assured trade destruction is obvious. It is highly unlikely that any trade collapse will take place, but the fear alone has damaged market market confidence in recent months, and this has been bad news for Germany with around one in seven of their cars being sold in the UK. This is not the primary concern however, with news that a collapse in factory orders in December was driven by a nosedive in demand by markets outside of Europe. While it is unwise to speculate – I will do so nonetheless – the Sino–US trade war is yet to be fully resolved and with both parties adopting increasingly protectionist measures, the effect on wider markets has included frigid liquidity and dampened consumer confidence.https://platform.twitter.com/widgets.jsThat does not look good. #German #Factory #Orders disappoint in December. Outlook for the industrial production is deteriorating. pic.twitter.com/4AfL9DkbDm

— Stefan Grosse (@NeuschneeNord) 6 February 2019

German economy: a nosedive prophesied from Deutsche Bank to Daimler

Today’s data on disappointing unemployment and industrial output figures comes only hours after Deutsche Bank (ETR:DBK) warns that Germany could be heading for another recession. “The start of the German economy into 2019 has been a major disappointment so far.” “The development of several key cyclical indicators is telling us that the German economy is drifting towards recession right now.”https://platform.twitter.com/widgets.js Vehicle manufacturing firm Daimler (ETR:DAI) then went on to announce that net earnings for 2018 fell over 49% on-year, “For Daimler, 2018 was a year of strong headwinds,” said CEO Dieter Zetsche, presenting his last annual results before handing off to successor Ola Kallenius. He added, “we cannot and will not be satisfied” with lower profit margins.Deutsche Bank Says German Economy Is Drifting Toward Recession https://t.co/XVXggfXLrx

— Rob Gill (@robdgill) 6 February 2019

What is the official position?

Chief Eurozone Economist at Pantheon Macroeconomics, Claus Vistesen, commented on the 1.6% month-on-month decline in factory orders going into December, “Across sectors, weakness in capital and intermediate goods were the primary drivers, especially on the export side to non-eurozone countries. By contrast, new orders for consumer goods rebounded strongly across the board, pointing to a revival in the auto sector towards the end of the year.” “The year-over-year rate was depressed by base effects from a very strong finish to the year in 2017, but the message remains clear: German manufacturing is suffering.” The German Economy Ministry has since weighed in, stating, “The decline in orders in December suggests that the weak phase in industry will continue for now.” “The latest sentiment indicators also point to muted momentum at the start of the year.”So what are we to think?

With all sincerity it is hard to find anything to be positive about in regard to this news. While innuendos were dropped throughout the course of 2018 that would lead pundits to doubt the steadfast nature of Germany’s economy, any market expert would be telling a lie if they said a German economic decline would not be a worry to other countries. It was forecast last year that a global recession could be on the distant horizon, with currency crises cropping up across developing economies struggling to pay back loans against an inflated US dollar. However, a pincer effect, with a domino of struggling economies both developed and developing, should send alarm bells ringing for policy-makers the world over. Of course, Germany is not the only G8 member facing financial woe, with Italy slumping into another recession after ineffective fiscal and monetary policy from its defiant leadership. With interest rates at near zero percent, the UK especially should fear the ramifications of an international slump. Brexit proceedings have proved quite how incapable our political representatives are at dealing with matters of political significance – so what then, can we expect from a crisis caused by monetary and political forces, when we struggled enough from the last crisis brought on almost exclusively by the greed of financiers?Snap Inc q4 figures beat expectations

Snap Inc (NYSE:SNAP) q4 figures beat market expectations, causing shares to bounce on Wednesday.

The owner of Snapchat said that daily active users were flat in the fourth quarter at 186 million, offering some respite to investors after two quarters of consecutive decline.

Analysts had been expecting a fall in users for the final quarter of the year.

Chief Executive Evan Spiegel, commented: “We are substantially closer to achieving profitability, as we have maintained a relatively flat cost structure across the past five quarters while growing full-year revenue 43 per cent year-over-year,”

Snap Inc has been struggling since its floatation on the New York Stock Exchange in 2017, amid a declining user base, with its share price falling to an all-time low in September.

Whilst initially immensely popular, Snapchat users have fallen in recent years amid fierce competition from other social media platforms such as Twitter (NYSE:TWTR) and Facebook-owned (NASDAQ:FB) Instagram.

The introduction of the Instagram story feature in particular proved problematic for Snapchat, bearing similarities to its messaging platform.

As a result, Snap Inc has failed to successfully differentiate itself from its competitors.

Whilst Snap Inc have accordingly attempted to shift their focus away from the App, rebranding as a “camera company”, its other products have not proved as commercially popular.

Its first version of Spectacles, a pair of smart glasses that permits video recording, only sold 220,000 pairs.

Moreover, various senior officials have departed the firm in recent months.

Most recently, the firm’s CFO Tim Stone announced his departure in January, having only joined Snap from Amazon 8 months prior.

Human resources chief, Jason Halbert, Vice President of Marketing Steve LaBella and Chief Strategy Officer Imran Khan have all left the company in the last year.

Shares in Snap Inc are currently +1.73% as of 12:19PM (GMT), on the back of the announcement.